Living in the UK, £38,000 after tax might sound like a comfortable salary. But let’s be honest, Sarah, a vibrant artist in Edinburgh, knows it can feel like juggling flaming chainsaws sometimes. Rent eats a big chunk, groceries vanish in a blink, and that trip to Loch Ness suddenly seems like a distant dream. Sarah isn’t alone, but fret not! This guide is your financial compass, helping you navigate the maze of post-tax realities and make your £38,000 sing.

Table of Contents

Understanding Your Take-Home Pay

- Tax Maze: Income Tax and National Insurance (NICs) take their bite. With £38,000, you’ll keep roughly £29,500 after the 20% tax and 12% NICs deductions. Regional variations like Scotland’s different tax bands might affect your net pay slightly.

- Deductions and Credits: Claim back your hard-earned cash! Pensions and student loan repayments can offer tax relief.

- Pay Slip Breakdown: Pay Before Tax (PBT) is your gross salary. Deductions take out NICs, student loans, and your chosen pension contribution. Net Pay is what finally lands in your bank account.

Unveiling the Net Pay Maze

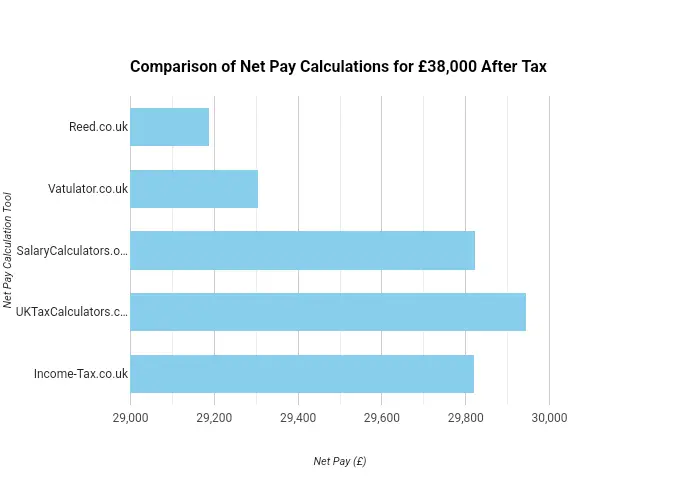

Calculating your exact net pay isn’t a simple equation. Online tools can help, but their results may vary slightly based on factors like:

| Tool | Take-Home Pay (Annual) | Monthly Pay | Weekly Pay |

|---|---|---|---|

| Reed.co.uk | £29,188 | £2,432 | £561 |

| Vatulator.co.uk | £29,305 | £2,442 | £566 |

| SalaryCalculators.org | £29,822.40 | £2,485.20 | £577.30 |

| UKTaxCalculators.co.uk | £29,944 | £2,495.33 | £581.33 |

| Income-Tax.co.uk | £29,822 | £2,485.20 | £577.30 |

As you can see, the net pay for £38,000 ranges from £29,188 to £29,944, a difference of almost £800! Don’t be discouraged, it’s all about understanding how different factors influence your final number.

- Read now –

- 22000 after tax

- 35000 after tax

Budgeting with £38,000 After Tax

| Category | Key Points | 38,000 After Tax (£) |

|---|---|---|

| Net Pay | After taxes & deductions | £27,360 |

| Housing | 30% of net pay, average Bristol rent | £820 |

| Food | 10-15% of net pay | £274-£410 |

| Fuel & Transport | 10-15% of net pay | £274-£410 |

| Other Expenses | Bills, leisure, etc. | £5,472-£8,208 |

| Debt Management | Prioritize high-interest debts | |

| Savings & Investments | 3-6 months’ living expenses | £8,208-£16,416 |

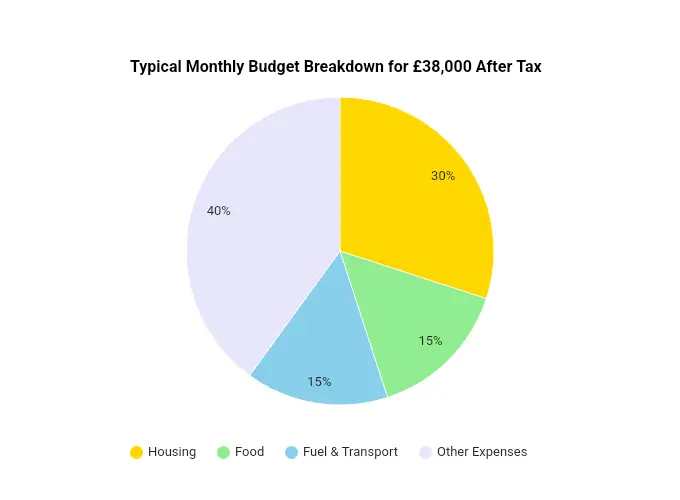

- 30% for Housing: Sarah in Edinburgh might be looking at around £885 for rent. Check average costs in your area with resources like Shelter.

- 10-15% for Food: £380-£570 per month can be realistic for Sarah. Meal planning, budget supermarkets, and home cooking are your allies.

- 10-15% for Fuel and Transport: Consider cycling, walking, public transport passes, or carpooling to keep Sarah’s expenses around £380-£570.

- 20-30% for Other Expenses: This covers everything from bills to leisure. Download our budget template to customize your spending plan!.

check out – vat calculator

Debt Management:

- Prioritize High-Interest Debts: Tackle credit card debt first using the snowball or avalanche method.

- Negotiate and Consolidate: Don’t be afraid to haggle for lower interest rates or consider debt consolidation loans.

Savings and Investments:

- Emergency Fund: Aim for 3-6 months’ worth of living expenses for unexpected storms.

- Retirement: Starting a workplace pension is crucial. Consider ISA contributions for additional long-term savings.

Lifestyle Tweaks for a Fatter Wallet:

- Groceries: Plan meals, compare prices, embrace store brands, and cook at home.

- Dining Out: Pack lunches, limit takeaways, and enjoy free entertainment like picnics in the park.

- Transport: Cycle, walk, use public transport passes, or carpool.

Boosting Your Income:

- Side Hustles: Freelancing, online gigs, tutoring, or selling crafts – unleash your skills for extra cash.

- Upskilling and Promotion: Invest in new skills to climb the career ladder and boost your salary.

Advanced Strategies for Financial Fitness:

- Tax Optimization: Claim all eligible deductions and credits, and consider tax-efficient savings like ISAs.

- Building Wealth: Invest in stocks, ETFs, or mutual funds, diversifying your portfolio

Advanced Strategies for Building Wealth with 38,000 After Tax:

Making your money work for you:

- Professional Advice: Consider seeking guidance from a financial advisor for personalized investment strategies.

- Automated Investing: Utilize platforms like robo-advisors for automatic investment based on your risk tolerance and goals.

- Equity Investments: Explore owning shares in companies for long-term growth potential.

- Property Investment: Consider buying property for rental income or capital appreciation (research regulations and risks carefully).

Expanding Your Financial Horizon:

- Passive Income Streams: Look into options like dividend-paying stocks, rental properties, or online businesses that generate income even when you’re not actively working.

- Entrepreneurial Ventures: If your artistic spirit craves a challenge, consider starting your own business based on your skills and passions.

Remember

- Financial goals: Define your short- and long-term financial goals to guide your investment decisions.

- Risk Tolerance: Assess your risk tolerance and choose investment options that align with your comfort level.

- Diversification: Don’t put all your eggs in one basket! Spread your investments across different asset classes to manage risk.

- Regular Review: Regularly review your financial plan and adjust it as needed based on life changes or market fluctuations.

Maxi,s Success Story

Follow mixi as she implements these strategies. Watch her optimize taxes, master budgeting, land a lucrative side hustle as an art teacher, and start investing in a small art gallery. Her journey proves that financial freedom on £38,000 is achievable, even in Edinburgh!

Conclusion

Making £38,000 after tax work in the UK isn’t just about surviving, it’s about thriving. Sarah, our Edinburgh artist, navigated the maze and so can you! Remember, financial security is a journey, not a destination. With the right tools, information, and a bit of artistic spirit, you can turn your £38,000 into a springboard for a brighter future.

ALSO visit – money saving guide

Take Action and Thrive:

- Download our resources: Use the budgeting template, tax checklist, and investment guide to personalize your financial journey.

- Stay informed: Subscribe to our newsletter for updates on financial news, investment tips, and cost-of-living changes.

- Seek support: Don’t hesitate to reach out to financial advisors, debt management counselors, or online communities for guidance.

I hope this complete guide helps you navigate the complexities of your £38,000 after-tax reality and build a fulfilling future in Edinburgh, or wherever your artistic journey takes you!