Last update 28 March 2024

VAT Calculator

| Amount (£) | VAT Rate (%) | VAT Amount (£) | Total Amount with VAT (£) |

|---|

VAT Calculator UK – Easily Calculate VAT for Your Business or Personal Use

Have you ever wondered what VAT (value added tax) is or how to easily calculate it? Our free online VAT calculator makes it simple to compute VAT and final costs for any amount in seconds. Whether you run a small business, handle finances and accounting, or just want to understand VAT better, this tool has you covered.

What is VAT? A Brief Primer

VAT is a consumption tax levied on most goods and services sold to consumers. Over 160 countries worldwide utilize some form of VAT to raise government revenue. Rates vary across jurisdictions but tend to fall between 5-25%.

In the European Union, EU directive 2006/112/EC sets minimum VAT standard rates at 15%. As an example, the current VAT rate in the UK stands at 20%. VAT registrants collect tax on sales and remit appropriate amounts after deducting VAT paid on business purchases.

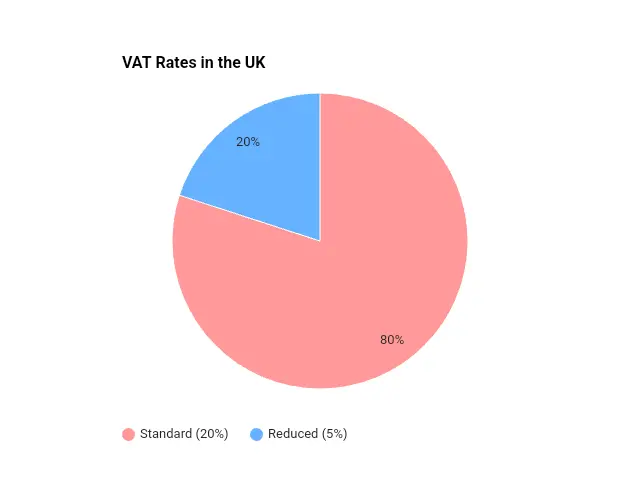

20% VAT

- This is the standard VAT rate in the UK and applies to most goods and services.

- This means that for every £1 you spend on a product or service subject to the standard VAT rate, you will also pay an additional 20 pence in VAT.

- For example, if you buy a new phone for £500, you will also pay £100 in VAT, bringing the total price to £600.

5% VAT

- This is the reduced VAT rate in the UK and applies to a limited number of goods and services, such as:

- Domestic fuel and power: This includes gas, electricity, and heating oil.

- Children’s car seats: This applies to car seats specifically designed for children under the age of 12.

- Home energy-saving materials: This includes insulation, double glazing, and solar panels.

- This means that for every £1 you spend on a product or service subject to the reduced VAT rate, you will also pay an additional 5 pence in VAT.

- For example, if you buy a new boiler for £1,000, you will also pay £50 in VAT, bringing the total price to £1,050.

0% VAT

- This is the zero VAT rate in the UK and applies to a wider range of goods and services, such as:

- Most food: This includes groceries, takeaways, and restaurant meals.

- Children’s clothes and footwear: This applies to clothes and footwear designed for children under the age of 16.

- Books, newspapers, and magazines: This applies to both physical and digital versions.

- Public transport: This includes buses, trains, and trams.

- This means that you do not pay any VAT on products or services subject to the zero VAT rate.

- For example, if you buy a loaf of bread for £1, you will not pay any VAT, and the price will remain £1.

VAT differs from sales tax in the US in a few key ways:

- VAT applies at multiple production and distribution stages rather than just the point of final retail sale

- VAT uses credit subtraction methods rather than being calculated directly as a percentage of price

- VAT exempts certain necessity goods like food and medicine which would still incur sales tax

Who Needs to Register for VAT?

You must register for VAT if you:

- Own a business with VAT taxable turnover above a set registration threshold

- Buy or sell goods or services within the EU over set limits

- Wish to voluntarily register even if not required

In the UK, you hit the VAT registration threshold when your taxable turnover exceeds £85,000 within a 12 month period. Note that not all goods and services count as part of taxable turnover. Certain insurance, financial, medical, educational, and postal services get exempted for instance.

Check with your country’s tax authority to determine applicable VAT registration rules and thresholds specific to your situation. Registration opens you up to collect, claim, and/or be refunded VAT depending on your position in the supply chain.

How Is VAT Calculated?

VAT runs off a credit subtraction system that avoids cascading taxes. Here is an example of how VAT calculations work through a supply chain:

- A parts supplier sells £100 worth of parts to a widget manufacturer

- The parts supplier charges 20% VAT so receives £100 for parts + £20 VAT = £120 total

- The widget manufacturer buys the parts for £120 (£100 parts + £20 VAT)

- The manufacturer then builds widgets costing £50 in labor and other overheads

- The total widget cost stands at £170 (£120 parts + £50 labor/overheads)

- The manufacturer sells completed widgets for £200 + 20% VAT

- So the customer pays £240 (£200 widget + £40 VAT)

- But the manufacturer deducts the £20 VAT already paid and remits only the difference of £20 (£40 collected – £20 input tax credit) to tax authorities

- This avoidance of tax layering continues down the supply chain until widgets reach the final consumer

So even though VAT gets repeatedly applied at intermediate stages, subtraction mechanisms grant businesses credit for taxes already paid to avoid unfair doubling up. The consumer still bears the ultimate incidence in the form of higher final prices.

Why Use a VAT Calculator?

Calculating 20% British VAT in your head works fine for quick restaurant bills or other back of the envelope situations. But making repeated business VAT computations with varying rates and amounts easily becomes complex and time consuming.

That’s why our customizable VAT calculator exists! It accurately handles all the number crunching instantly so you don’t have to. Simply enter any base amount along with the correct VAT percentage rate and currency to automatically generate VAT amounts, sale prices incl. VAT, and VAT exclusive sale costs.

Whether you need help with routine financials and invoices, want to evaluate profit margin impacts of VAT changes, or just wish to better visualize how VAT functions – our free online VAT calculator has you covered. The simple intuitive interface makes VAT calculations painless rather than painful.

UK VAT Rates and Examples

| VAT Rate | Description | Products and Services (Examples) |

|---|---|---|

| 0% | Zero-rated | * Most food (excluding restaurant meals) * Children’s clothes and shoes * Books and newspapers * Public transport fares * Domestic fuel and power * Certain medical equipment |

| 5% | Reduced-rate | * Energy-saving materials for homes * Home insulation installation * Car seats for children * Residential caravans with no engine |

| 20% | Standard-rate | * Most goods and services not listed above * Restaurant meals * Clothing (except children’s) * Electronics * Furniture * Hairdressing services * Hotel accommodation * Pay TV subscriptions * Mobile phone contracts |

VAT Calculator Privacy

Rest assured our VAT tool processes all user input data securely without storing or sharing any of it externally. We will never sell or distribute your information to third parties. Calculations happen directly within your web browser rather than over the internet.

You maintain complete control over any confidential data used. Simply clear the calculator form when done to erase details. For added peace of mind, consider accessing this VAT calculator through a privacy-focused browser configured to avoid tracking.

check now- Vat Calculator Ireland

How to Use the VAT Calculator

Navigating our easy VAT calculator takes just seconds. Simply follow these steps:

- Enter Base Amount: First input the base amount that needs VAT calculated. This represents the sale price excluding any VAT. For example for a £100 widget, enter 100.

- Select VAT Rate: Choose the appropriate VAT rate percentage from the dropdown menu. Common rates like 20% UK VAT automatically show as defaults for convenience. But custom rates work too.

- Pick Currency: Lastly pick the correct currency that the base amount gets measured in from the currency menu. This ensures VAT gets calculated and displayed properly in pounds, euros etc.

- Hit Calculate: Finally click the large friendly “Calculate” button to automatically generate the VAT amount and Sale Price Incl. VAT in real time.

Below the calculator form, you’ll also find two toggle buttons:

- Show Excluded: Displays the base amount separate from VAT amount.

- Show Included: Shows VAT amount included with the base as the final sale price.

Sample VAT Calculation

Let’s walk through a quick example VAT scenario to demonstrate using the calculator in practice:

- You sell software subscriptions for £50/user/month

- You need to register for VAT after hitting the registration threshold

- 20% is the prevailing VAT rate in your jurisdiction

- VAT will impact pricing decisions and must get accurately calculated

Simply input the following values into our VAT calculator:

- Base Amount = 50

- VAT Rate = 20%

- Currency = GBP £

The following output automatically generates:

- VAT Amount = £10

- Total Sale Price (Incl. VAT) = £60

So with £50 as the original pre-tax pricing, adding in 20% VAT of £10 brings the new total to £60 per software subscription when billing customers. The VAT calculator output matches manual calculations but saves the effort of working this out step-by-step yourself.

Now you can correctly build VAT on top of base amounts for entire price lists and invoices rather than just a single value. The calculator makes updating pricing as easy as changing that base input and hitting calculate again. Streamlining business VAT compliance couldn’t be simpler!

VAT Calculator Formula

Wondering what formula gets used under the hood powering the VAT calculator math? Here it is in case you’re curious:

- VAT Amount = Base Amount x (VAT Rate ÷ 100)

- (Non-display caveat being VAT amount gets rounded appropriately depending on currency and magnitude)

- Sale Price Incl. VAT = Base Amount + VAT Amount

And that’s really it! The tool handles applying the proper VAT rate you select to any base amount entered and presents the end sale price with VAT included or separated per your choice.

No more fussing about with manual spreadsheets. The heavy lifting formula math gets reliably computed for you automatically instead.

- Adding VAT to a Price

- Formula:

- Price including VAT = Price excluding VAT x (1 + VAT rate)

- Example:

- If a product costs £100 excluding VAT and the VAT rate is 20%, the price including VAT would be:

- £100 x (1 + 0.20) = £100 x 1.20 = £120

- If a product costs £100 excluding VAT and the VAT rate is 20%, the price including VAT would be:

2. Calculating the VAT Amount

- Formula:

- VAT amount = Price including VAT – Price excluding VAT

- Example:

- Using the same example above, the VAT amount would be:

- £120 – £100 = £20

- Using the same example above, the VAT amount would be:

3. Removing VAT from a Price

- Formula:

- Price excluding VAT = Price including VAT / (1 + VAT rate)

- Example:

- If a product costs £120 including VAT and the VAT rate is 20%, the price excluding VAT would be:

- £120 / (1 + 0.20) = £120 / 1.20 = £100

- If a product costs £120 including VAT and the VAT rate is 20%, the price excluding VAT would be:

The Power of VAT Calculators UK:

These handy tools streamline VAT calculations, offering numerous advantages:

- Save Time and Effort: No more manual calculations; simply enter values and get instant results.

- Accuracy Guarantee: Eliminate errors and ensure compliance with HMRC regulations.

- Additional Features: Currency conversion, record-keeping tools, and integration with accounting software enhance functionality.

VAT Rates in the European Union

Value Added Tax (VAT) is an indirect tax applied to most goods and services sold within the European Union. While all EU countries must charge VAT, the specific rates vary depending on the country and the type of goods or services being taxed.

Here’s a summary of VAT rates in the EU:

- Standard VAT rate: This is the rate applied to most goods and services. It must be at least 15% but there is no upper limit. The current average standard VAT rate in the EU is 21%.

- Reduced rates: EU countries can choose to apply one or two reduced rates to certain goods and services, such as food, books, and public transport. These rates must be at least 5%.

- Super-reduced rate: Some countries also have a super-reduced rate, which is below 5%.

Here are some resources where you can find more information about VAT rates in the EU:

- European Commission: https://taxation-customs.ec.europa.eu/vat-rates_en

- Your Europe: https://europa.eu/youreurope/business/taxation/vat/vat-rules-rates/index_en.htm

- Tax Foundation: https://taxfoundation.org/data/all/eu/value-added-tax-2023-vat-rates-europe/

- Eurofiscalis: https://www.eurofiscalis.com/en/switzerland/

VAT Calculator Features Summary

In case the above explanations didn’t make it blindingly obvious already, here’s a quick recap of awesome built-in features:

Flexible Inputs

- Enter any base amount, VAT percentage rate, currency

- Change inputs dynamically to recalculate

Instant Calculation

- Outputs VAT amount + Sale Price (Incl. VAT) instantly

- Toggle to also display Sale Price (Excl. VAT)

Interactive Visualization

- Resizable stacked bar charts

- Mouseover tooltips reveal figures

- Zoom, pan etc. for clarity

Use Any Device

- Mobile and desktop friendly responsive design

- Access the VAT calculator anywhere

Secure and Private

- No login required

- Nothing gets stored or tracked

Conclusion

With the intricacies of VAT taxation only growing more complex globally, our free online VAT calculator helps cut through the confusion. Accurately calculate VAT across various jurisdictions and amounts in seconds with privacy assured. Visual tools grant further insights into how VAT operates.

Whether you’re responsible for business finances, managing international ecommerce taxation compliance, or just seeking to expand mental math abilities – give this handy VAT calculator a try now!

Calculator Disclaimers

- This VAT calculator serves as an informational tool only. Double check exact figures against official tax authority guidance before finalizing any legally binding VAT reporting or remittances.

- We make no guarantee of accuracy for the computed results and assume no liability for potential errors or outdated rates. Always perform supplemental manual checks using official published VAT rules and figures in your jurisdiction.

- The calculator beta contains known issues displaying certain currencies and may inaccurately round some edge amounts or percentages. Fixes remain under active development. Use caution when evaluating edge cases.

- No data entered into this tool gets permanently stored or shared externally in any way. Outputs stay local to your device browser during active use only. Remember to clear the calculator form when finished for maximum privacy.