Imagine earning a decent £22,000 in the vibrant city of Bristol, James. Yet, payday brings more anxiety than relief. Rent gulps down a chunk, groceries deplete the rest, and dreams of exploring Bath seem like a distant echo. James isn’t alone. Demystifying your “22,000 after tax” reality is crucial in the UK, and this guide aims to be your financial compass.

Unraveling the Tax Maze

- Income Tax: Your £22,000 falls into the 20% tax bracket, leaving you with a seemingly comfortable £17,600. But hold on, that’s just the beginning!

- National Insurance Contributions (NICs): 12% of your income, munching away another £2,640. This mandatory contribution funds public services and gets deducted directly from your salary.

- Regional Variations: Scotland has its own income tax bands, so your net pay might differ slightly north of the border.

Deductions and Credits: Claim back your hard-earned cash!

- Pensions: Contributing to a workplace pension scheme gets you tax relief, boosting your retirement nest egg.

- Student Loans: Repaying student loans qualifies you for tax relief, easing the burden slightly.

Understanding Your Pay Slip

- Pay Before Tax (PBT): Your gross salary before any deductions.

- Deductions: NICs, student loan repayments, pension contributions.

- Net Pay: What finally lands in your bank account.

Calculating Your 22k After Tax

Unveiling the net pay maze involves twists and turns of tax deductions and allowances. Online tools can help:

| Tool | Take-Home Pay (Annual) | Monthly Pay | Weekly Pay |

|---|---|---|---|

| Reed.co.uk | £15,607 | £1,300 | £300 |

| Vatulator.co.uk | £15,725 | £1,310 | £303 |

| SalaryCalculators.org | £15,841.60 | £1,320.13 | £306.28 |

| UKTaxCalculators.co.uk | £15,960 | £1,330 | £308.69 |

| Income-Tax.co.uk | £15,841.60 | £1,320.13 | £306.28 |

As you can see, the net pay for £22,000 ranges from £15,607 to £15,960, a difference of almost £350! This variation stems from how each tool accounts for factors like:

- Personal Allowances: Depending on your circumstances, you may be entitled to tax-free allowances that reduce your taxable income.

- Employment Status: Full-time, part-time, and self-employed individuals have different tax implications.

- Student Loan Repayments: If you have outstanding student loans, repayments are typically deducted before you receive your pay.

check out – VAT Calculator

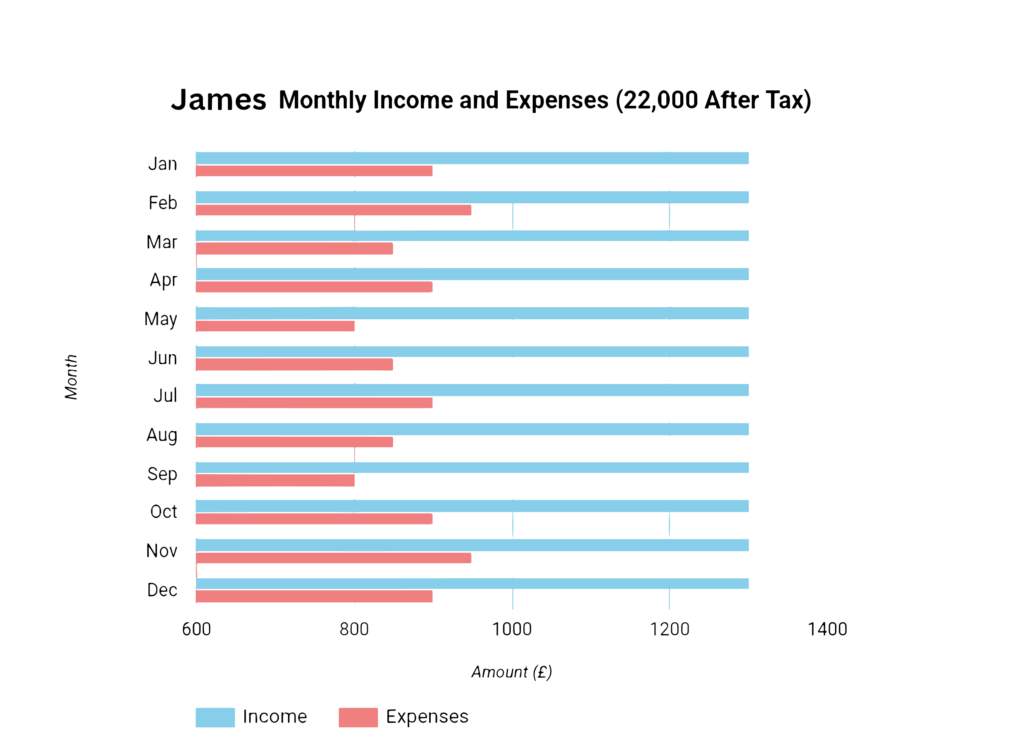

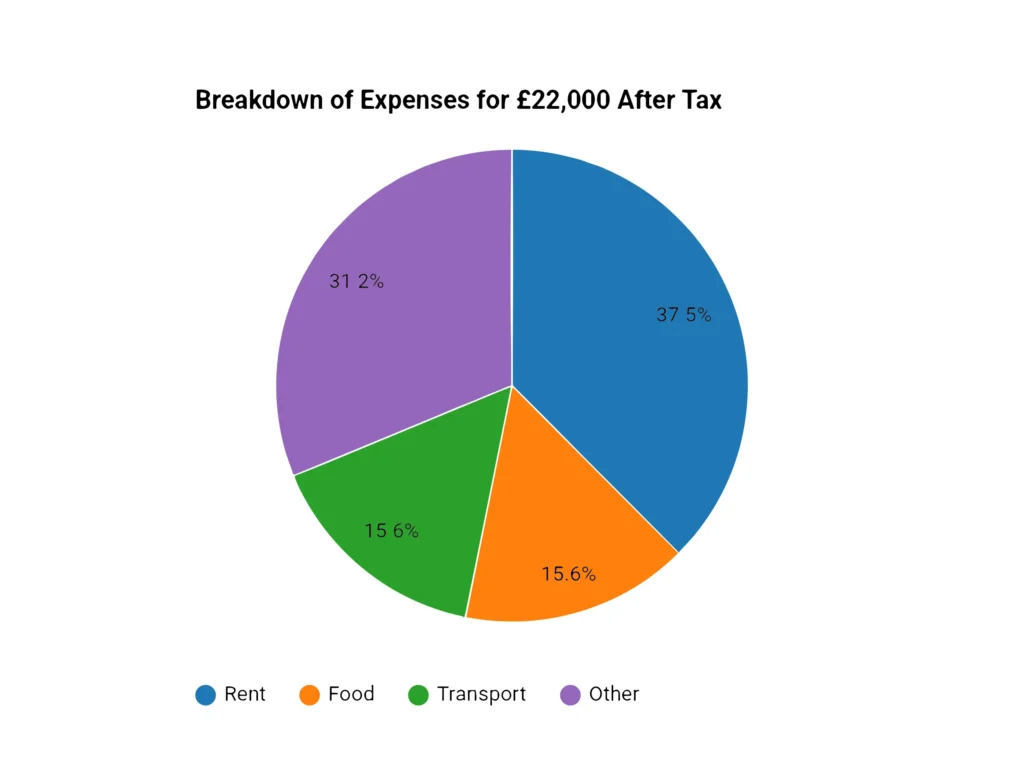

Budgeting with 22,000 After Tax

| Category | Key Points |

|---|---|

| Net Pay | £15,607 after taxes & deductions |

| Housing | 30% of net pay, ~£470/month (Bristol average rent) |

| Food | 10-15% of net pay, ~£234-£351/month |

| Fuel & Transport | 10-15% of net pay, ~£234-£351/month |

| Other Expenses | 20-30% of net pay, bills, leisure, etc. |

| Debt Management | Prioritize high-interest debts (snowball vs avalanche) |

| Savings & Investments | 3-6 months’ living expenses (~£5,882-£11,764) |

| Workplace pension (employer matched) | |

| Consider ISA contributions for long-term savings | |

| Lifestyle Tweaks | Groceries: meal planning, store brands, cook at home |

| Dining out: pack lunches, limit takeaways | |

| Transport: cycle, walk, public transport passes, carpool | |

| Boosting Income | Side hustles: freelancing, online gigs, tutoring, etc. |

| Upskilling and promotion for higher salary | |

| Advanced Strategies | Tax optimization, building wealth (stocks, ETFs) |

- Take-Home Pay: £15,607 after NICs (average from tools).

- Housing: Around 30%, so rent might be roughly £470 for Sarah in Bristol. Check the average costs in your area using resources like Shelter.

- Food: Aim for 10-15%, around £234-£351 for Sarah. Meal planning, budget supermarkets, and home cooking are your allies.

- Fuel and Transport: 10-15%, around £234-£351. Consider cycling, walking, or public transport where possible.

- Other Expenses: 20-30%, covering everything from bills to leisure. Use free activities in your town, like museums or parks, to enjoy your leisure budget.

Download our budgeting template to customize your spending plan!

Debt Management:

- Prioritize High-Interest Debts: Tackle credit card debt first. Use the snowball method (paying off smaller debts first) or the avalanche method (targeting debts with the highest interest rates).

- Negotiate and Consolidate: Don’t be afraid to haggle for lower interest rates or consider debt consolidation loans to simplify your repayments.

Savings and Investments:

- Emergency Fund: Aim for 3-6 months’ worth of living expenses to weather unexpected storms.

- Retirement: Starting a workplace pension is crucial. Consider ISA contributions for additional long-term savings.

Sure, here’s the continuation of the guide:

Retirement: Starting a workplace pension is crucial. Consider ISA contributions for additional long-term savings.

Lifestyle Tweaks for a Fatter Wallet

- Groceries: Plan meals, compare prices, embrace store brands, and cook at home.

- Dining Out: Pack lunches, limit takeaways, and enjoy free entertainment like picnics in the park.

- Transport: Cycle, walk, use public transport passes, or carpool.

Boosting Your Income:

- Side Hustles: Freelancing, online gigs, tutoring, pet-sitting – unleash your skills for extra cash.

- Upskilling and Promotion: Invest in new skills to climb the career ladder and boost your salary.

Advanced Strategies for Financial Fitness:

- Tax Optimization: Legally minimize your tax bill:

- Claim all eligible deductions and credits.

- Utilize tax-efficient savings like ISAs.

- Building Wealth: Secure your future:

- Invest in stocks, ETFs, or mutual funds.

- Diversify your portfolio to manage risk.

- Seek professional financial advice if needed.

James’s Success Story

Follow James as she implements these strategies. Watch her optimize taxes, navigate budgeting, and land a lucrative side hustle as a photographer. Her journey proves that financial security on £22,000 is achievable!

Conclusion

Living comfortably on £22,000 after tax isn’t a walk in Hyde Park, but it’s far from an impassable Everest. Remember, James, our Bristol barista, navigated the maze, and so can you! Now, let’s wrap up with some final takeaways:

Key Points to Remember:

- Understand your take-home pay: Taxes and deductions nibble at your salary, but knowing the numbers empowers you to budget effectively.

- Budgeting is your best friend: Allocate your income smartly, prioritizing essentials and finding room for fun without breaking the bank.

- Embrace smart living: Cost-cutting hacks and alternative transportation can stretch your pounds further.

- Explore income boosts: Side hustles and career advancement can add valuable financial fuel.

- Plan for the future: Saving for rainy days and building long-term wealth are crucial for future peace of mind.

Take Action and Thrive:

- Download our resources: Use the budgeting template, tax checklist, and other downloadable tools to personalize your financial journey.

- Stay informed: Subscribe to our newsletter for updates on tax laws, cost-of-living changes, and financial tips.

- Seek support: Don’t hesitate to reach out to financial advisors, debt management counselors, or even online communities for guidance.

Bonus Resources:

- MoneySavingExpert: https://www.moneysavingexpert.com/

- Citizens Advice: https://www.citizensadvice.org.uk/

- National Debtline: https://nationaldebtline.org/contact-us/

Remember, financial security is a journey, not a destination. With the right tools, information, and mindset, you can navigate the labyrinth of finances and build a brighter future, even on a £22,000 after-tax income. So, take a deep breath, James, and start your journey today!