Earning £30,000 in the UK is a decent starting point for many careers, but how much of that actually ends up in your pocket? Understanding your net pay or take-home pay is crucial for budgeting, financial planning, and making informed decisions about your future. This comprehensive guide delves into the world of UK taxes and National Insurance, helping you calculate your take-home pay from £30,000 and explores strategies to boost your income and keep more of your hard-earned cash.

Decoding Your Take-Home Treasure

- Tax Maze: Income Tax and National Insurance (NICs) take their bite. With £30,000, you’ll keep roughly £23,400 after the 20% tax and 12% NICs deductions. Regional variations like Scotland’s tax bands might slightly alter your net pay.

- Deductions and Credits: Claim back your rightful booty! Pensions and student loan repayments offer tax relief, adding a little gleam to your treasure chest.

- Pay Slip Breakdown: Pay Before Tax (PBT) is your gross salary. Deductions take out NICs, student loans, and your chosen pension contribution. Net Pay is what finally lands in your pocket like a shiny sovereign.

Understanding Your Net Pay Numbers

Calculating your exact net pay isn’t a walk in Hyde Park. Online tools can be your guide, but their results may vary slightly based on factors like:

| Tool | Take-Home Pay (Annual) | Monthly Pay | Weekly Pay |

|---|---|---|---|

| Reed.co.uk | £23,045 | £1,920 | £446 |

| Vatulator.co.uk | £23,165 | £1,930 | £448 |

| SalaryCalculators.org | £23,281.60 | £1,940 | £450.80 |

| UKTaxCalculators.co.uk | £23,400 | £1,950 | £452.31 |

| Income-Tax.co.uk | £23,281.60 | £1,940 | £450.80 |

As you can see, the net pay for £30,000 ranges from £23,045 to £23,400, a difference of almost £350! Understanding these variations is crucial for budgeting effectively.

check out now – VAT Calculator

Budgeting: Your Financial Map

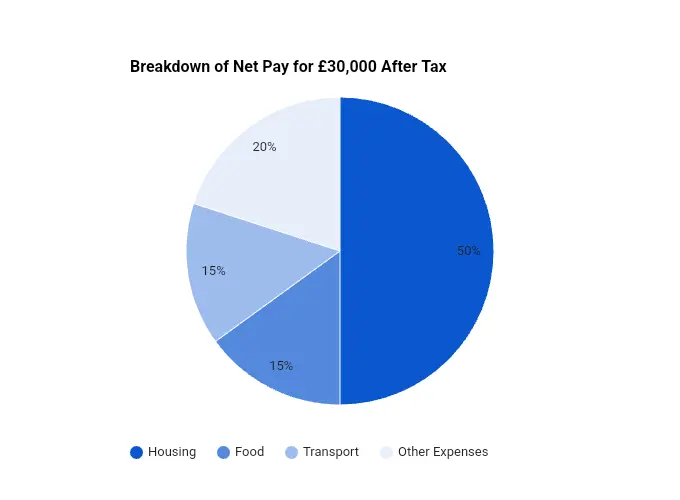

- Track Your Spending: Where does your treasure flow? Utilize budgeting apps or spreadsheets to gain insights and identify areas for improvement.

- 50/30/20 Rule: Allocate roughly 50% of your income to needs (housing, food, transport), 30% to wants (entertainment, hobbies), and 20% to savings and debt repayment.

- Embrace Free Adventures: Explore free museums, parks, libraries, and community events to have fun without breaking the bank.

- Cook at Home: Eating out can quickly drain your resources. Plan meals, cook in bulk, and utilize leftovers.

Boosting Your Treasure Chest

- Side Hustles: Unleash your hidden skills with freelance work, online gigs, or selling crafts. Consider your hobbies and talents for extra income.

- Upskilling and Promotion: Invest in learning new skills that can lead to higher earning potential in your current job or open doors to better opportunities.

- Negotiate Your Salary: If comfortable, research your market value and negotiate a raise with your employer, especially if your responsibilities have increased.

Remember:

- Financial Goals: Define your short- and long-term goals (e.g., saving for a house, travel) to guide your financial decisions.

- Prioritize Needs: Differentiate between essential expenses and desires to avoid overspending.

- Seek Support: Don’t hesitate to reach out to financial advisors, debt management counselors, or online communities for guidance.

Read now – 35000 after tax

Advanced Strategies for Building Wealth

- Tax Optimization: Claim all eligible deductions and credits, and consider tax-efficient savings like ISAs.

- Building Wealth: Invest in stocks, ETFs, or mutual funds, diversifying your portfolio to manage risk.

- Professional Advice: Consider seeking guidance from a financial advisor for personalized investment strategies.

Remember:

- Financial goals: Define your short- and long-term financial goals to guide your investment decisions.

- Risk Tolerance: Assess your risk tolerance and choose investment options that align with your comfort level.

- Diversification: Don’t put all your eggs in one basket! Spread your investments across different asset classes to manage risk.

- Regular Review: Regularly review your financial plan and adjust it as needed based on life changes or market fluctuations.

Beyond the Tax Maze: Unleashing the Full Potential of £30,000 After Tax

Navigating the financial landscape with £30,000 after tax isn’t just about budgeting and avoiding the taxman’s grasp. It’s about charting a course towards financial freedom, a journey filled with exploration, discovery, and ultimately, empowerment. Here’s how you can go beyond the basic strategies and unlock the full potential of your income:

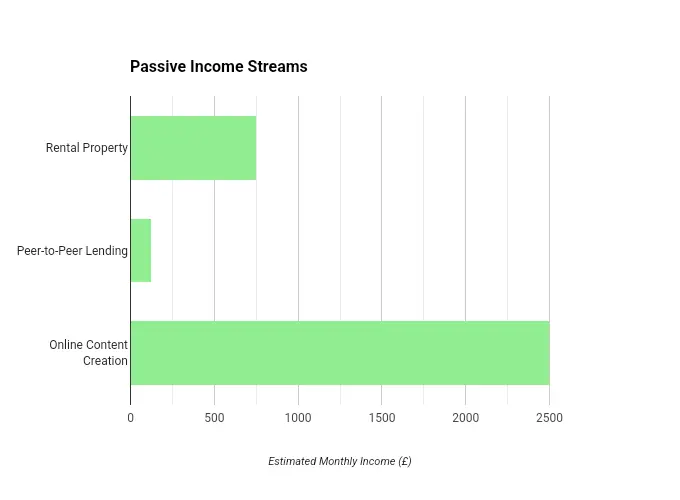

Building Passive Income Streams

- Invest in rental properties: This can be a long-term strategy for generating income while building equity. However, thorough research and understanding of the risks involved are crucial.

- Explore peer-to-peer lending: Lend your money to individuals or businesses and earn interest. Platforms like Zopa and RateSetter offer opportunities for diversification and potential returns.

- Create online content: Build a blog, YouTube channel, or social media presence that generates advertising revenue or affiliate marketing income. Remember, consistency and quality are key.

Investing for the Future:

- Start an Individual Savings Account (ISA): ISAs offer tax-free growth on your investments, a powerful tool for long-term wealth building. Explore various ISA options like Cash ISAs, Stocks & Shares ISAs, and Innovative Finance ISAs to suit your goals and risk tolerance.

- Consider robo-advisors: For a hands-off approach, automated investment platforms like Nutmeg or Wealthsimple can manage your portfolio based on your risk profile and goals.

Embracing Entrepreneurship

- Turn your passion into profit: Do you have a unique skill or hobby? Explore freelancing, consulting, or starting your own small business. Remember, entrepreneurship comes with its own set of challenges, so careful planning and market research are essential.

- Invest in existing businesses: Consider angel investing or crowdfunding platforms to support exciting startups and potentially earn returns on your investment.

Remember:

- Seek Professional Guidance: Financial advisors and wealth managers can offer personalized advice based on your unique circumstances and risk tolerance.

- Stay Informed: Keep abreast of financial news, investment trends, and tax changes to make informed decisions.

- Celebrate Milestones: Acknowledge your progress, however small, to stay motivated on your financial journey.

Your Financial Odyssey Awaits:

With the right strategies and a proactive approach, navigating the financial landscape with £30,000 after tax can be an enriching and empowering experience. Remember, you are not just managing your money; you are charting your course towards financial freedom and a brighter future. Embrace the adventure, explore the possibilities, and unlock the full potential of your £30,000!