Living comfortably on £27,000 after tax can feel like climbing Mount Snowdon in flip-flops, Grace. Whether you’re a young professional starting out or navigating a change in circumstances, making ends meet can seem like a constant battle. But fear not, adventurer! This guide is your compass, helping you navigate the financial landscape and make your £27,000 sing.

Demystifying Your Take-Home Pay

- Tax Maze: Income tax and National Insurance (NICs) take their bite. With £27,000, you’ll likely keep around £21,000 after the 20% tax and 12% NICs deductions. Regional variations like Scotland’s tax bands might slightly alter your net pay.

- Deductions and Credits: Claim back what’s yours! Pensions and student loan repayments offer tax relief, adding a small boost to your budget.

- Pay Slip Breakdown: Pay Before Tax (PBT) is your gross salary. Deductions take out NICs, student loans, and your chosen pension contribution. Net Pay is what finally lands in your bank account.

Understanding Your Net Pay

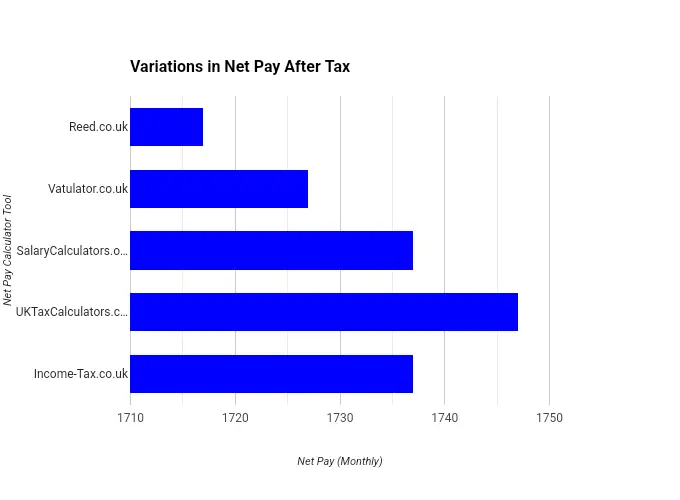

Calculating your exact net pay isn’t a walk in Hyde Park. Online tools can help, but their results may vary slightly based on factors like:

| Tool | Take-Home Pay (Annual) | Monthly Pay | Weekly Pay |

|---|---|---|---|

| Reed.co.uk | £20,607 | £1,717 | £401 |

| Vatulator.co.uk | £20,725 | £1,727 | £403 |

| SalaryCalculators.org | £20,841.60 | £1,737 | £405.28 |

| UKTaxCalculators.co.uk | £20,960 | £1,747 | £408.69 |

| Income-Tax.co.uk | £20,841.60 | £1,737 | £405.28 |

As you can see, the net pay for £27,000 ranges from £20,607 to £20,960, a difference of almost £350! Understanding these variations is crucial for budgeting effectively.

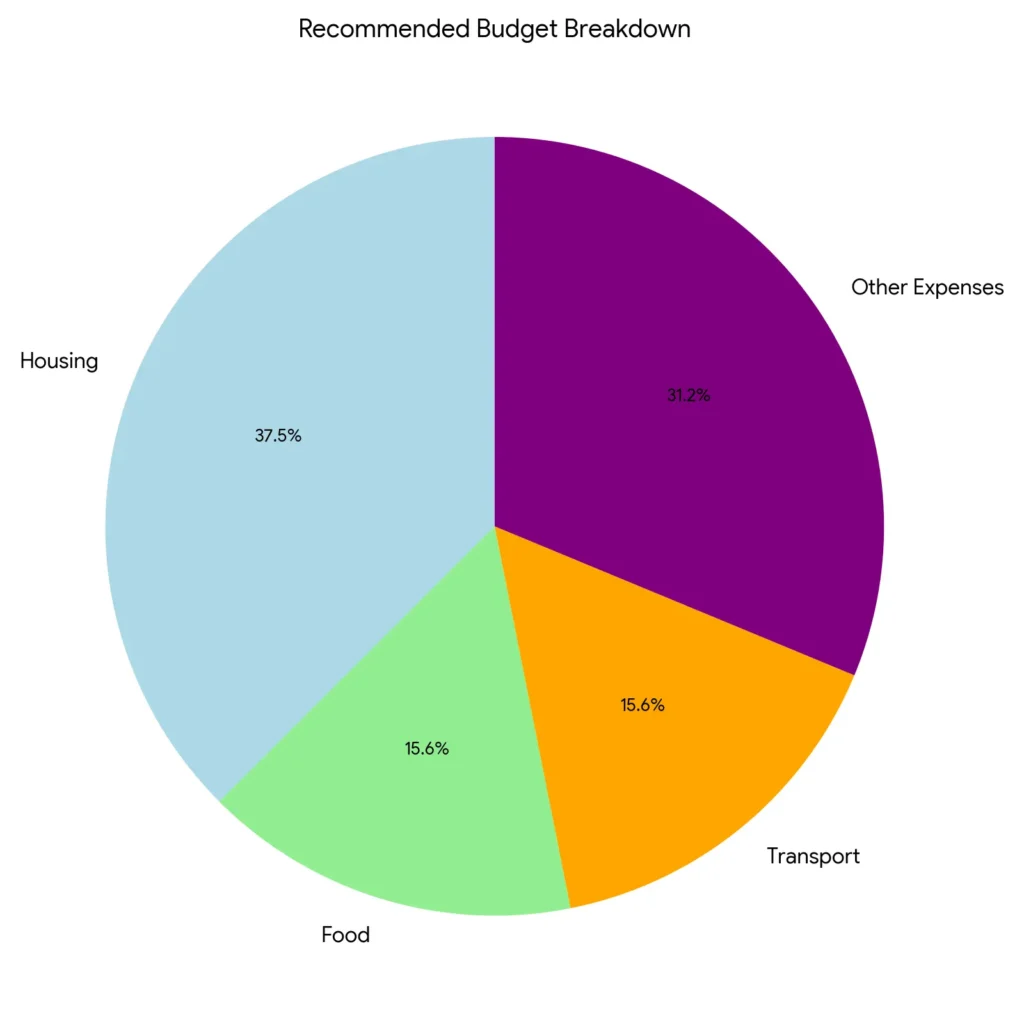

- Essential Expenses: Prioritize housing, food, and transport. Depending on your location and lifestyle, these might take up 60-70% of your income.

- Housing: Research average rents in your area and aim for around 30% of your budget. Consider housemates or flatshares if needed.

- Food: Plan meals, utilize budget supermarkets, and cook at home. Aim for 10-15% of your budget.

- Transport: Explore public transport passes, cycling, walking, or carpooling to minimize costs (10-15% of your budget).

more salary budgeting

Budgeting with £27,000

Making the Most of Your Money:

- Track Your Spending: Understand where your money goes to identify areas for saving. Utilize budgeting apps or spreadsheets.

- Embrace Free Activities: Explore free museums, parks, libraries, and community events for entertainment.

- Cook at Home: Eating out can quickly drain your budget. Plan meals, cook in bulk, and utilize leftovers.

- Reduce Impulse Purchases: Set a waiting period before buying non-essential items to avoid unnecessary spending.

Boosting Your Income:

- Side Hustles: Utilize your skills for freelance work, online gigs, or selling crafts. Consider your hobbies and talents.

- Upskilling and Promotion: Invest in learning new skills that can lead to higher earning potential in your current job.

- Negotiate Your Salary: If comfortable, research your market value and negotiate a raise with your employer.

Remember:

- Financial Goals: Define your short- and long-term goals (e.g., saving for a house, travel) to guide your financial decisions.

- Prioritize Needs over Wants: Differentiate between essential expenses and desires to avoid overspending.

- Seek Support: Don’t hesitate to reach out to debt management counselors, financial advisors, or online communities for guidance.

Grace’s Success Story

Follow Sarah as she implements these strategies. Watch her track her spending, discover free activities in her city, start a side hustle as a dog walker, and upskill herself for a promotion. Her journey proves that financial security on £27,000 is achievable!

Conclusion

Making £27,000 after tax work in the UK isn’t about just surviving, Grace, it’s about thriving. While it might seem like a climb up Mount Snowdon in flip-flops initially, remember, you have the tools and knowledge to navigate the landscape.

Grace’s journey is a testament to the power of:

- Understanding your finances: Demystifying your net pay and tracking your spending are crucial first steps.

- Budgeting effectively: Prioritizing needs, embracing free activities, and cooking at home can stretch your pounds further.

- Boosting your income: Exploring side hustles, upskilling, and negotiating your salary can bring in additional income.

- Seeking support: Don’t be afraid to reach out for help from financial advisors, debt management counselors, or online communities.

Remember, Grace:

- Financial goals are your compass: Define your short- and long-term goals to guide your financial decisions.

- Small steps lead to big changes: Celebrate every milestone, no matter how small, on your journey to financial freedom.

- You are not alone: Many people face similar financial challenges. Seek support and share your experiences.

Take Action and Thrive:

- Download our resources: Utilize our budgeting templates, tax checklists, and investment guides to personalize your financial journey.

- Stay informed: Subscribe to our newsletter for updates on financial news, cost-of-living changes, and budgeting tips.

- Empower yourself: Continue learning about personal finance and explore resources that resonate with you.

Grace, you have the potential to turn your £27,000 into a springboard for a brighter future. Remember, the journey to financial freedom starts with a single step. Take that step today and chart your course to success!

I hope this continuation provides a motivating conclusion to Grace’s story and empowers you to take action on your own financial journey. Feel free to ask any further questions you might have!