London, a city pulsating with life, promises endless possibilities, but for Alex, a budding architect navigating the bustling streets, £48,000 after tax can feel like juggling confetti in a hurricane. Rent devours a sizeable chunk, groceries disappear in a flash, and that weekend escape to Brighton suddenly seems as fleeting as a summer dream. Yet, Alex isn’t alone. This guide aims to be your financial anchor, helping you navigate the whirlwind of post-tax realities and make your £48,000 sing like a Big Ben chime.

Unveiling the Take-Home Treasure

- Tax Maze Deciphered: Income Tax and National Insurance (NICs) take their bite. With £48,000, your net pay hovers around £37,700 after the 20% tax and 12% NICs deductions. Regional variations like Scotland’s tax bands might slightly alter your final number.

- Deductions and Credits: Claim them back! Pensions and student loan repayments offer tax relief, adding a little gleam to your treasure chest.

- Pay Slip Breakdown: Pay Before Tax (PBT) is your gross salary. Deductions take out NICs, student loans, and your chosen pension contribution. Net Pay is what finally lands in your pocket like a shiny sovereign.

Navigating the Net Pay Labyrinth

Calculating your exact net pay isn’t a walk in Hyde Park. Online tools can be your guide, but their results may vary slightly based on factors like:

| Tool | Take-Home Pay (Annual) | Monthly Pay | Weekly Pay |

|---|---|---|---|

| Reed.co.uk | £37,186 | £3,099 | £715 |

| Vatulator.co.uk | £37,305 | £3,109 | £720 |

| SalaryCalculators.org | £37,822.40 | £3,152 | £732.50 |

| UKTaxCalculators.co.uk | £37,944 | £3,162 | £736.50 |

| Income-Tax.co.uk | £37,822 | £3,152 | £732.50 |

Don’t fret over the differences, Alex! Understanding how individual factors influence your net pay is key.

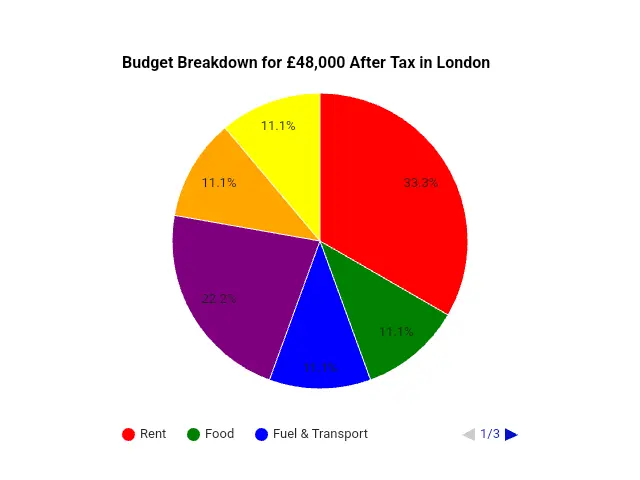

Budgeting with £48000 After Tax

- 30% for Housing: London might eat a bigger chunk of your pay in rent. Alex could be looking at around £1,139. Check average costs in your area using resources like Shelter.

- 10-15% for Food: Aim for £471-£706 per month. Meal planning, budget supermarkets, and home cooking are your culinary allies.

- 10-15% for Fuel and Transport: Consider cycling, walking, public transport passes, or carpooling to keep Alex’s expenses around £471-£706.

- 20-30% for Other Expenses: This covers everything from bills to leisure. Download our budget template to personalize your spending plan!

check out – VAT Calculator

Debt Management

- High-Interest Debts First: Credit card debt? Use the snowball or avalanche method for a swift escape.

- Negotiate and Consolidate: Don’t be afraid to haggle for lower interest rates or consider debt consolidation loans.

Savings and Investments

- Emergency Fund: Aim for 3-6 months’ worth of living expenses for unexpected storms.

- Retirement: Starting a workplace pension is crucial. Consider ISA contributions for additional long-term savings.

Lifestyle Tweaks for a Fatter Wallet

- Groceries: Plan meals, compare prices, embrace store brands, and cook at home. Pack lunches and limit takeaways.

- Transport: Cycle, walk, use public transport passes, or carpool. Explore free activities like museums or parks.

Boosting Your Income

- Side Hustles: Freelancing, online gigs, tutoring, or selling architectural prints – unleash your skills for extra cash.

- Upskilling and Promotion: Invest in new skills to climb the career ladder and boost your salary.

Read now – 38000 after tax

Advanced Strategies for Financial Fitness

- Tax Optimization: Claim all eligible deductions and credits, and consider tax-efficient savings like ISAs.

- Building Wealth: Invest in stocks, ETFs, or mutual funds, diversifying your portfolio to manage risk.

- Seek Professional Advice: Consider guidance from a financial advisor for personalized investment strategies.

Alex’s Success Story: From Hustle to Haven

Follow Alex as they implement these strategies. Watch them optimize taxes, master budgeting, land a lucrative side hustle designing for local restaurants, and start investing in a small architectural firm. Their journey proves that financial freedom on £48,000 is achievable, even in the heart of London!

Remember:

- Financial goals: Define your short- and long-term financial goals to guide your decisions.

- Risk Tolerance: Assess your risk tolerance and choose investment options that align with your comfort level.

- Diversification: Don’t put all your eggs in one basket! Spread your investments across different asset classes to manage risk.

- Regular Review: Regularly review your financial plan and adjust it as needed based on life changes or market fluctuations.

Take Action and Thrive

- Download our resources: Use the budgeting template, tax checklist, and investment guide to personalize your financial journey.

- Stay informed: Subscribe to our newsletter for updates on financial news, investment tips, and cost-of-living changes.

- Seek support: Don’t hesitate to reach out to financial advisors, debt management counselors, or online communities for guidance.

Conclusion

Making £48,000 after tax work in London isn’t just about surviving, it’s about thriving. Alex, our budding architect, navigated the whirlwind and so can you! Remember, financial security is a journey, not a destination. With the right tools, information, and a bit of London grit, you can turn your £48,000 into a springboard for a brighter future.

Go beyond the blitz, Alex, and build your financial haven!

I hope this continues the guide and offers encouragement and actionable tips for Alex’s financial journey. Please let me know if you have any further requests!