Ever wondered how much you’d actually bring home after earning £22,500 in the UK? Understanding your net pay or take-home pay is crucial for budgeting, financial planning, and making informed decisions about your future. This comprehensive guide delves into the world of UK taxes and National Insurance, helping you calculate your take-home pay from £22,500 and explore strategies to maximize your income.

22500 after tax

What does “22,500 after tax in the UK” mean?

This refers to the amount of money you’ll receive after deductions for income tax and National Insurance contributions from your gross salary of £22,500. So, while you see £22,500 on your payslip, the actual amount you get to spend is slightly lower.

Importance of understanding take-home pay:

Knowing your net pay empowers you to:

- Budget effectively: Allocate funds for rent, groceries, bills, savings, and investments with more accuracy.

- Compare job offers: Evaluate true compensation beyond the headline salary figure.

- Plan for future expenses: Estimate affordability for a bigger house, car, or unexpected costs.

Who should read this article?

Anyone who earns income in the UK, especially those:

- Starting their careers or changing jobs.

- Unsure about how much they’ll actually take home from their salary.

- Interested in exploring tax-saving strategies to keep more of their hard-earned cash.

check out – vat calculator

Understanding UK Taxes and National Insurance

The UK tax system comprises income tax and National Insurance contributions. Let’s break it down:

Income tax bands and rates

Your income tax depends on the tax band you fall into based on your taxable income (gross salary minus the personal allowance). Think of it like a tiered system, with each band having its own tax rate. Here’s the current structure (as of April 2024):

- Personal allowance: £12,570 (tax-free) – This is the good news! The first chunk of your income is tax-free.

- Basic rate: 20% on income between £12,571 and £50,270 – Most people earning £22,500 fall into this category.

- Higher rate: 40% on income above £50,270 – If you’re earning significantly more than £22,500, be prepared for a higher tax bite.

Personal allowance and how it affects your net pay:

The personal allowance acts like a shield, protecting a portion of your income from tax. The higher your income, the less impact this allowance has on your net pay. For example, someone earning £50,000 only benefits from the first £12,570 of the allowance, while the rest of their income falls into the higher tax bracket.

National Insurance contributions:

These contributions fund the UK’s social security system, ensuring you have access to healthcare, unemployment benefits, and state pensions in the future. There are two main categories:

- Class 1: Paid by employees and deducted from their salary (12% on earnings between £9,880 and £50,270) – This is the most common type of National Insurance you’ll encounter as an employee.

- Class 2: Paid by self-employed individuals (flat rate of £3.15 per week) – If you’re your own boss, you’ll be responsible for paying both income tax and Class 2 National Insurance.

Other potential tax deductions and contributions:

- Student loan repayments: If you took out a student loan to fund your education, you’ll make repayments automatically through your salary deductions.

- Pension contributions: Putting money aside for your retirement can attract tax relief, meaning you get some of your contribution back from the government.

- Charitable donations: Donating to charity can also reduce your tax bill under certain circumstances.

Feeling overwhelmed? Don’t worry! The UK government provides a handy tax calculator to help you estimate your take-home pay: https://www.gov.uk/estimate-income-tax. You can also find more detailed information on income tax and National Insurance on the HMRC website: https://www.gov.uk/government/organisations/hm-revenue-customs.

Calculating Your Take-Home Pay from £22,500

Hare a quick comparison of different online tools and their estimated net pay for £22,500:

| Tool | Take-Home Pay (Annual) | Monthly Pay | Weekly Pay |

|---|---|---|---|

| Reed.co.uk | £17,186 | £1,432 | £334 |

| Vatulator.co.uk | £17,305 | £1,442 | £337 |

| SalaryCalculators.org | £17,422.40 | £1,452 | £338.50 |

| UKTaxCalculators.co.uk | £17,544 | £1,462 | £341.50 |

| Income-Tax.co.uk | £17,422 | £1,452 | £338.50 |

As you can see, the net pay ranges from £17,186 to £17,544, a difference of almost £360! To choose the right tool, consider:

- Accuracy: Look for tools known for their reliable calculations and up-to-date tax information.

- Customization: Choose a tool that allows you to input your specific deductions and circumstances for a more precise result.

- Transparency: Understand the calculation methodology and assumptions used by the tool.

home pay

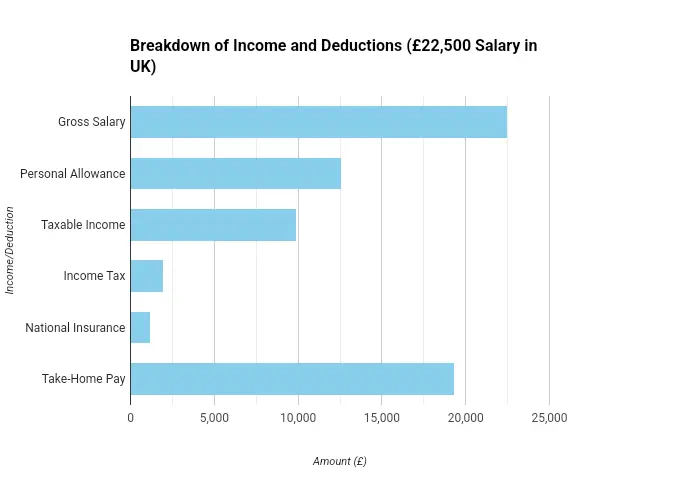

- Identify your tax band: Based on your taxable income (£22,500 – £12,570 = £9,930), you fall into the basic tax band.

- Calculate income tax: £9,930 x 20% = £1,986. Remember, this is the amount of tax you’ll pay on the portion of your income that falls above the personal allowance.

- Calculate National Insurance: For employees earning between £9,880 and £50,270, Class 1 National Insurance is 12%. So, £9,880 x 12% = £1,185.60.

- Subtract deductions: Now, add up your income tax and National Insurance and subtract them from your gross salary: £22,500 – £1,986 – £1,185.60 = £19,328.40. This is your approximate take-home pay!

Real-life example:

Imagine Racks, a young professional starting her first job with a £22,500 salary. Using the steps above, she calculates her take-home pay to be around £19,328.40. This means she’ll receive roughly £1,610.70 per month, £371.54 per week, or £53.08 per day (assuming 5 working days).

Remember: This is just an estimate, and your actual take-home pay might vary slightly depending on factors like student loan repayments, pension contributions, or additional deductions specific to your situation.

What £22,500 After Tax Looks Like in Real Life

So, how does a take-home pay of £19,328.40 translate into everyday life?

- Monthly: This translates to roughly £1,610.70. Enough to cover rent, groceries, bills, and some fun activities in many areas of the UK.

- Weekly: This breaks down to £371.54 per week. Remember, this is before any further deductions you might have.

- Daily: Assuming 5 working days, it’s around £53.08 per day. Not bad for a starting salary!

Of course, your living costs will vary depending on your location and lifestyle. London is notoriously expensive, while smaller towns offer more affordable options. Consider using a budgeting app or online tool to estimate your expenses and see how your take-home pay fits into your financial picture.

Budgeting with £22,500

Now that you have a clearer picture of your net pay, let’s delve into budgeting. Here are some guidelines:

- 50/30/20 Rule: Allocate 50% of your income to essential expenses (housing, food, transport), 30% to discretionary spending (entertainment, clothes), and 20% to savings or debt repayment.

- Housing: Research average rents in your area. Aim for around 30% of your budget, which translates to roughly £525 per month. Consider housemates or flatshares for affordability.

- Food: Plan meals, utilize budget supermarkets, and cook at home to save. Allocate 10-15% of your budget, around £265-£348 per month.

- Transport: Explore public transport passes, cycling, walking, or carpooling to minimize costs. Aim for 10-15% of your budget, around £265-£348 per month

Tax-Saving Strategies for Boosting Your Take-Home Pay

Now that you understand the basics, let’s explore some ways to keep more of your hard-earned money:

Maximize your personal allowance:

- Claim tax relief for eligible work-related expenses like travel or professional subscriptions.

- Consider making charitable donations, as these can sometimes reduce your tax bill.

Utilize tax-efficient investment schemes:

- ISAs (Individual Savings Accounts): Invest up to £20,000 annually in tax-free savings accounts. Grow your wealth without worrying about the taxman!

- Pensions: Contributions receive tax relief, and pension income in retirement is typically taxed at a lower rate. Start saving for your golden years early and enjoy tax benefits along the way.

Reduce National Insurance contributions (if applicable):

- Claim married couple’s allowance: If married or in a civil partnership, one partner can transfer £1,260 of their personal allowance to the other, potentially reducing their National Insurance contributions.

- Start a side hustle: If you’re self-employed, your first £9,880 of profits are exempt from Class 2 National Insurance. Turn your hobby into a money-making side hustle and enjoy this tax perk.

Explore employer benefits and salary sacrifice options

- Salary sacrifice: Agree to reduce your gross salary in exchange for employer contributions to pensions, childcare vouchers, or cycle-to-work schemes. This lowers your taxable income and National Insurance contributions, leaving you with more take-home pay.

- Employee benefits: Utilize tax-efficient benefits offered by your employer, such as health insurance or gym memberships. Stay healthy and save money at the same time!

Remember: These are just a few starting points. Consulting a financial advisor can help you explore personalized strategies based on your unique situation and financial goals.

Conclusion

Understanding your take-home pay and exploring tax-saving strategies empowers you to make informed financial decisions. Remember, financial planning is an ongoing process. As your income, circumstances, and goals evolve, revisit your calculations and explore new strategies to optimize your net pay and achieve your financial objectives.

By following these guidelines, I hope this comprehensive guide empowers individuals in the UK to understand and maximize their take-home pay, ultimately taking control of their financial well-being.